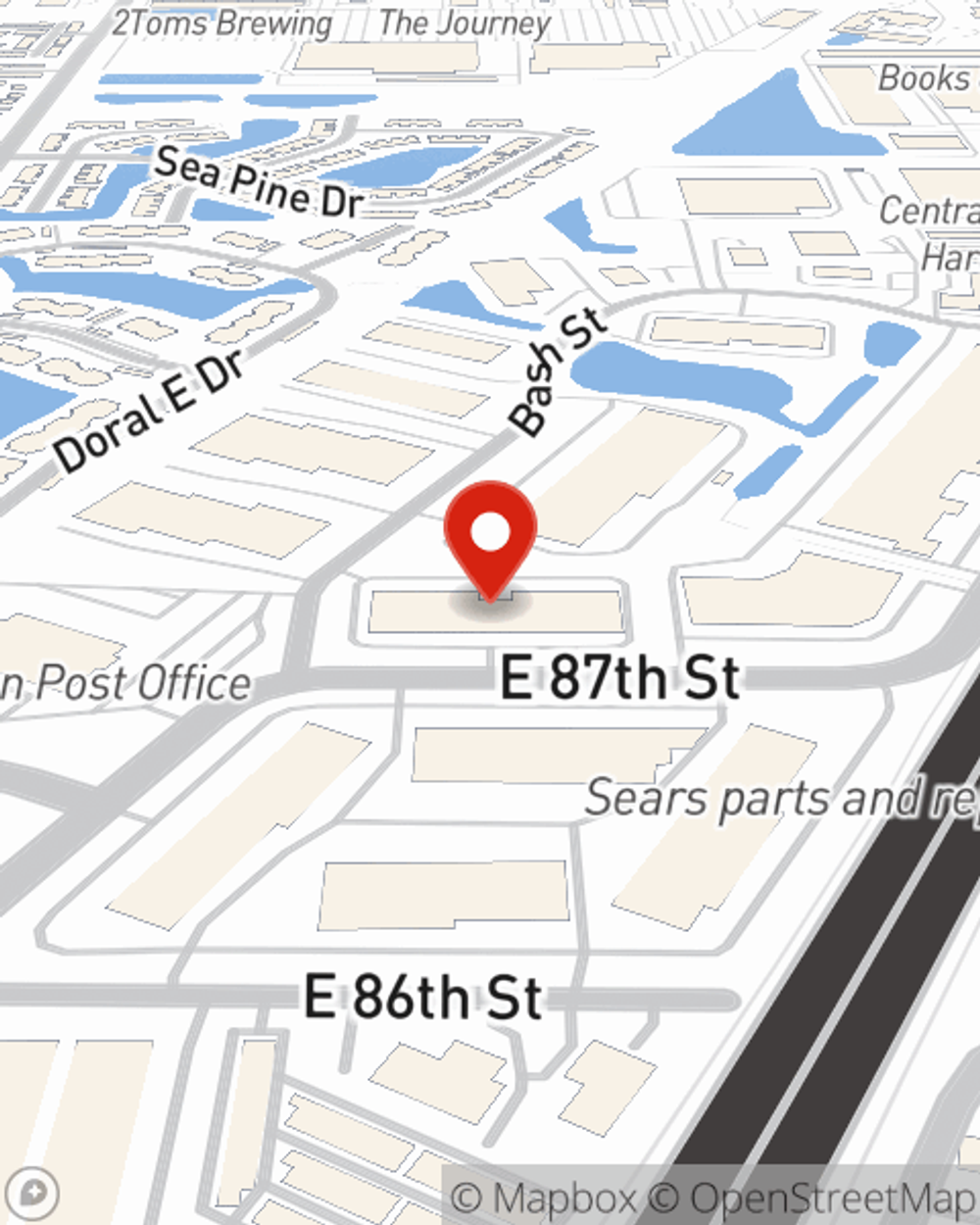

Renters Insurance in and around Indianapolis

Get renters insurance in Indianapolis

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Calling All Indianapolis Renters!

Think about all the stuff you own, from your clothing to couch to camping gear to pots and pans. It adds up! These belongings could need protection too. For renters insurance with State Farm, you've come to the right place.

Get renters insurance in Indianapolis

Renting a home? Insure what you own.

Why Renters In Indianapolis Choose State Farm

Renting a home makes the most sense for a lot of people, and so is protecting your belongings with insurance. In general, your landlord's insurance might cover damage to the structure of your rented home, but that doesn't include what you own. Renters insurance helps shield your personal possessions in case of the unexpected.

There's no better time than the present! Call or email Michelle Bryant-Jones's office today to get started on building a policy that works for you.

Have More Questions About Renters Insurance?

Call Michelle at (317) 572-1435 or visit our FAQ page.

Simple Insights®

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.

Michelle Bryant-Jones

State Farm® Insurance AgentSimple Insights®

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

What to do if you can’t pay rent

What to do if you can’t pay rent

Many people may need short-term help with rent payments. Whether due to job loss or unexpected costs, these options could help.